introduction to CRWV Stock Price

I’ll be straight with you. I’m a casual gamer—browser games, idle games, even the occasional mobile grind session. But lately, I’ve also been dabbling in something a little different: tech stocks. Not because I want to wear a suit and quote Warren Buffett, but because some of these companies are genuinely fascinating.

Take CoreWeave (CRWV) for example. It’s not just another cloud company—it’s a rising star in the AI infrastructure world, and the CRWV stock price has been climbing like a boss fight montage. I’m going to break it down in plain English, explain why it matters (even if you’re just here to click cookies), and show how this one-time crypto miner turned AI titan is catching serious attention.

What Is CoreWeave?

CoreWeave started back in 2017 as a crypto mining operation. You read that right. They were deep in Ethereum mining before shifting gears in a massive way. Fast forward a few years, and they’re now a full-blown AI cloud computing company. CRWV Stock Price

But not just any cloud service. CoreWeave specializes in GPU-based computing infrastructure. In simpler terms, they provide the ultra-powerful backend systems that companies need to train massive AI models, render complex graphics, or simulate physics engines. CRWV Stock Price

If you’ve ever wondered what runs those super-smart AIs in new-gen games, or powers machine learning algorithms for voice assistants and chatbots—this is the kind of tech CoreWeave is building.

Why Is CRWV Stock Price Making Headlines?

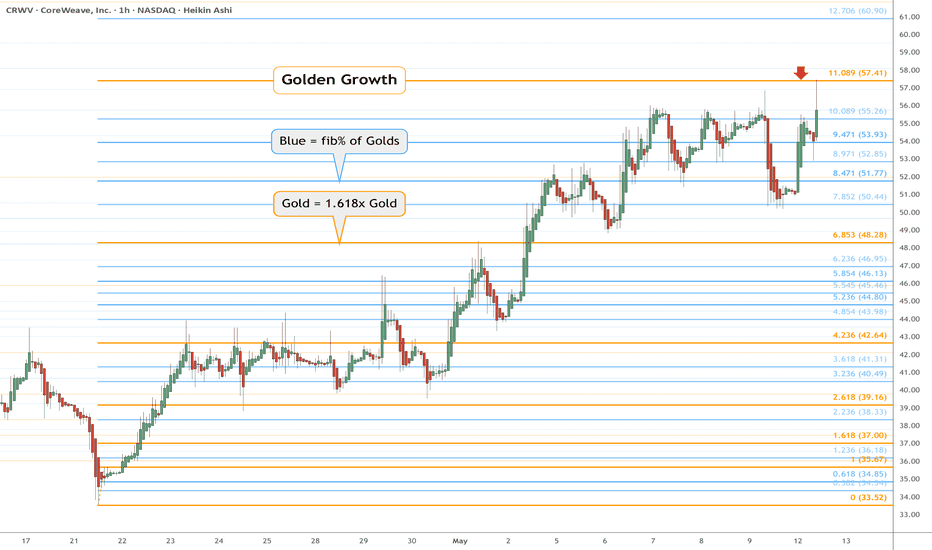

Let’s cut to the chase. The CRWV stock price launched at $40 during its IPO in March 2025. Just a couple of months later, it’s trading above $107. That’s a huge leap in a short time, and it didn’t happen by accident.

Several things lined up:

CoreWeave announced a $2 billion debt raise that was five times oversubscribed. Translation: Big investors scrambled to get in.

They inked a massive multi-billion-dollar deal with OpenAI to power AI models through 2029. CRWV Stock Price

Nvidia boosted its ownership stake from 5% to 7%. When the company behind your graphics card is backing a cloud provider, you pay attention.

This kind of growth isn’t common, especially in such a specialized sector. It signals that CoreWeave isn’t just some background player. They’re aiming to be one of the foundational pieces of the AI economy. CRWV Stock Price

Why Should Gamers and Casual Tech Fans Care?

Good question. I used to think this stuff had nothing to do with me. I was more concerned about my idle game stats than a stock price. But then I realized something. CRWV Stock Price

CoreWeave is building the infrastructure for AI—tech that’s changing how we play games.

Whether it’s better NPC behavior, smarter matchmaking, or faster development cycles, AI is becoming the backbone of modern gaming. CRWV Stock Price

Cloud performance matters to gamers.

If you’ve ever used a cloud gaming platform like GeForce NOW or Xbox Cloud Gaming, you know that smooth, lag-free play depends on powerful backend systems. CoreWeave is one of the companies providing that. CRWV Stock Price

Understanding tech trends helps you game smarter.

I’m not saying start day trading, but being aware of how this industry works gives you a better appreciation for the tech behind your hobby—and maybe a smart investment idea or two. CRWV Stock Price

CoreWeave by the Numbers

No jargon here—just the essentials.

Yes, they’re running at a loss right now, but that’s often the case with companies that are scaling fast. It’s like dumping all your upgrade points into speed early in a game—you might miss some short-term wins, but you’re positioning yourself for long-term domination. CRWV Stock Price

Strategic Partnerships That Matter

Let’s be honest—partnerships can make or break a tech company. And CoreWeave has some big names backing them: CRWV Stock Price

OpenAI signed a four-year deal valued up to $4 billion. That’s not pocket change.

Nvidia, one of the most respected names in computing, now owns a 7% stake.

Microsoft used Core-weave’s GPU s to meet some of their own AI infrastructure needs. CRWV Stock Price

These aren’t speculative bets. These are long-term relationships with the world’s biggest tech players. It gives CoreWeave serious credibility—and a steady revenue stream.

The Risks (Because No Stock is All Wins)

Every game has its challenges, and investing is no different. Here are a few things to keep in mind:

Customer concentration: In 2024, Microsoft accounted for 62% of CoreWeave’s revenue. If that relationship changes, it could cause a ripple effect.

Heavy spending: Core Weave plans to spend upwards of $23 billion in 2025 to meet demand. That’s a bold move and not without risk.

Debt load: With an $8.5 billion debt load, they’re playing an aggressive strategy. It could pay off—or cause problems if the market shifts.

That said, none of these are deal-breakers. Just realities of rapid growth in a booming industry.

What Do Analysts Say?

Analysts currently rate CRWV as a “Strong Buy.” The average price target is around $47 to $50, but given the stock’s performance, there’s reason to believe it could go higher. Especially if AI demand continues to explode.

It’s not a sure thing—but it’s a stock that tech-savvy people are watching closely. And let’s be real: sometimes, it’s the long shots that turn into champions.

How to Get Started (If You’re a Total Newbie)

If you’re thinking, “Maybe I want to try this,” but have no idea where to begin—don’t stress. It’s easier than you think.

Use platforms like Robinhood, Public, or Fidelity. They’re like inventory screens for your financial gear.

Start small. You don’t need to go all in—buy a few shares and learn the ropes.

Follow news like you follow patch updates. It helps you understand market changes without feeling overwhelmed.

Final Thoughts: Is CoreWeave the Real Deal?

From where I’m sitting? Absolutely.

They’ve gone from niche crypto miners to major players in one of the fastest-growing sectors in tech. They’ve got the backing, the partnerships, and the performance to make a real impact—not just in AI, but in the way our digital lives operate.

And if you’re a gamer like me who appreciates both great technology and a solid story arc, CoreWeave is worth watching. Whether or not you buy the stock, understanding how it fits into the bigger picture is like knowing the lore behind your favorite RPG. It just makes the experience richer.