Introduction to international distribution services share price

If you’ve been watching the marketplace this season, you’ve likely heard the stir surrounding International Distribution Services (IDS) – the mum or dad company of Royal Mail and GLS. Regardless of whether you’re a casual investor, a market enthusiast, or just somebody who’s curious why this legacy emblem is all of a sudden sizzling once more, get ready for a journey. The IDS percentage price has been a thrill ride in 2025, and we are here to unpack it all. international distribution services share price

From postal strikes to parcel booms, from European growth to AI-powered logistics, IDS is no longer just a sleepy postal provider. In this guide, we’ll discover anything from ancient tendencies to what the keen cash is announcing concerning the destiny. Pour your self a cuppa (or some thing more potent), because the plot thickens. international distribution services share price international distribution services share price

A Short History: From Royal Mail to IDS

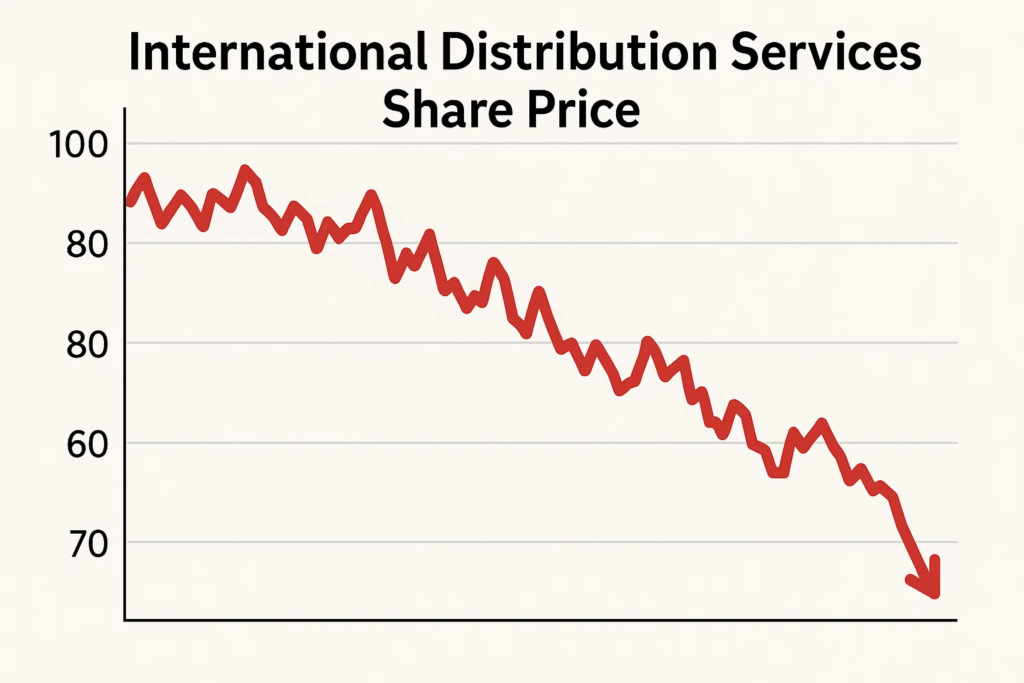

International Distribution Services wasn’t always the name noticed on the London Stock Exchange. Most folk still consider it as Royal Mail, the 500-year-historic establishment once run by using the British government. After its privatization and eventual rebranding as IDS in 2022, the company aimed to increase its scope beyond the UK. international distribution services share price

GLS, the European arm, turned into the crown jewel that justified the shift. IDS wanted to signal to investors that it’s greater than simply purple post vans. It’s a European logistics powerhouse in the making. This repositioning has had direct effects on share notion and charge volatility.

Current Share Price Trends: What 2025 Looks Like So Far

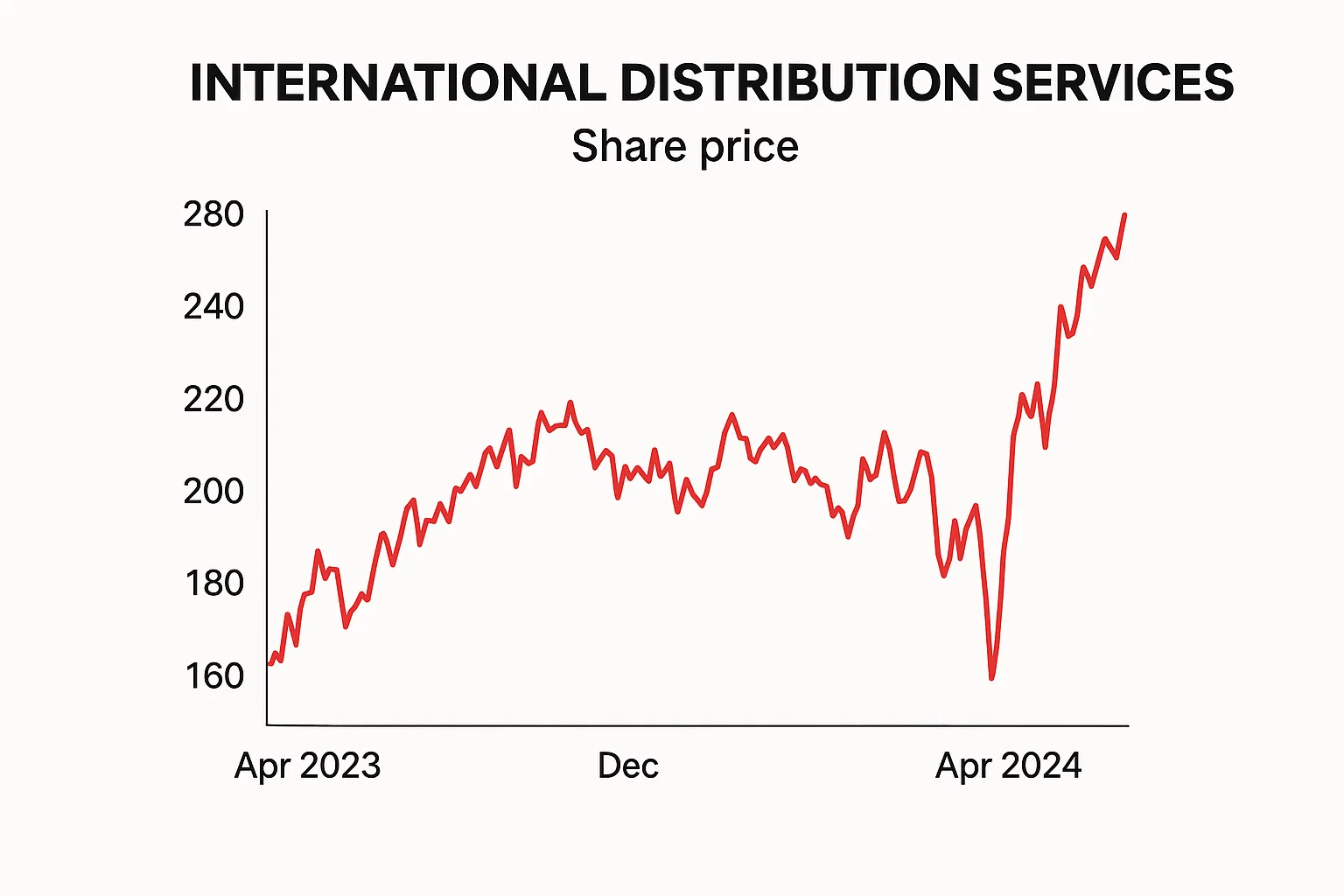

As of mid-2025, IDS shares have seen dramatic highs and lows. At the beginning of the year, shares lingered around 250p. By March, murmurs of strategic changes and new lucrative GLS contracts in Germany propelled them up to 300p. In June, after uneven financial results, the shares briefly dipped under 240p — only to rebound to 275p following news of a potential expansion into North America. international distribution services share price

It’s been a rollercoaster for sure. But also brimming with opportunity. Investors are watching each press announcement like hawks. It seems the market is responding more to future prospects than present numbers — and that tells us something significant.

Dividends: To Distribute or Not?

One major concern among dividend investors has been IDS’s inconsistent payout approach. Back in 2023, they paused dividends to reinvest in logistics technology. In 2024, they reinstated a modest dividend, signaling cautious optimism. international distribution services share price

In 2025, the dividend policy is under strategic review. Analysts believe a progressive dividend plan may roll out in Q4, especially if GLS profitability continues to rise. For income investors, this could mark a turning point in sentiment.

What’s Powering Growth? AI, Automation, and E-Commerce

What makes IDS suddenly exciting again? Three transformational forces: automation, e-commerce, and AI.

They’ve invested heavily in automating sorting centers, leveraging machine learning for route optimization, and expanding last-mile delivery capabilities. With e-commerce booming globally, IDS is positioning itself as a digital-first courier partner for businesses across Europe and beyond. international distribution services share price

While Royal Mail in the UK continues to face regulatory and labor challenges, GLS is proving to be the driving force of growth. For investors, that split focus presents both a risk and a reward. international distribution services share price

Risks on the Horizon: Strikes, Inflation & Competition

Let’s not sugarcoat things — IDS has some baggage. Royal Mail’s UK operations could still face the prospect of postal strikes, especially as union negotiations continue. Add inflationary pressures on fuel and wages, and the profit margin picture gets blurrier. Fierce competition also looms large. IDS is up against powerhouses like Amazon Logistics, Evri, and DHL. Any stumble in delivery speed or customer satisfaction can cost contracts. So while the stock shows promise, risks remain. international distribution services share price

Analyst Forecasts: Bullish or Bearish?

Ask around, and you’ll get differing views of IDS — it’s either a turnaround in progress or a value trap. But many analysts concur on one thing: the share price doesn’t reflect GLS’s full potential. Recently, Barclays upgraded IDS to “Overweight,” citing operational improvements and clear strategy. JPMorgan placed a 320p price target on the stock by 2025’s end, assuming GLS grows and UK operations stabilize. Retail investors on Reddit and elsewhere lean cautiously optimistic too, especially European logistics fans. It’s not frenzy, but discussion swirls. international distribution services share price

Should You Buy, Hold, or Sell?

Let’s get personal. For risk-tolerant types able to stomach near-term fluctuations, IDS could pay off. It trades at a price-to-earnings ratio implying undervaluation versus logistics peers. Income-focused folk wanting steady dividends may want to wait until Q4 when payout clarity comes. Long-term believers in European e-commerce and logistics could see this as an entry point before wider recognition. But searchers of quick flips or drama-haters may want to sit this one out. international distribution services share price

Final Thoughts: IDS Is a Dark Horse with Real Potential

The centuries-old postal service is actively reinventing itself for the new digital era through artificial intelligence and e-commerce integration. While facing challenges, IDS has incredible momentum and vision as one of the more undervalued stocks on the FTSE today. Whether it emerges as a top portfolio performer or a cautionary tale depends entirely on how well executives navigate an industry in upheaval. Stay informed through quarterly reports and union negotiations. This former mail carrier might just transform into tomorrow’s delivery leader. international distribution services share price

[…] Also read: {international distribution services share price} […]