introduction to personal tax account

In today’s fast-paced, tech-savvy world, handling taxes doesn’t have to be stressful, scary, or stuck in the past. Thanks to the Personal Tax Account (PTA), managing your finances has finally stepped into the modern era—and honestly, it feels pretty great. Whether you’re an employee, a freelancer, or juggling multiple income sources, your PTA is a powerful tool that can help you take control of your money with confidence and clarity.

This article is your go-to, no-fluff, fully loaded guide to understanding, using, and benefiting from your personal tax account in 2025 and beyond. We’ll walk through everything from setup and login, to practical use cases, advanced tips, and real-world benefits. Oh, and we’ll keep it real, relatable, and occasionally witty—because taxes shouldn’t be boring, right?

What is a Personal Tax Account? Why Should You Care?

Imagine a digital hub where all your tax affairs live—secure, accessible, and user-friendly. That’s your Personal Tax Account. Introduced by HMRC (Her Majesty’s Revenue & Customs) in the UK, this platform puts you in control of your personal tax info.

Think of it like your financial dashboard where you can check your income tax, claim refunds, update employment details, apply for tax-free allowances, and much more. And yes, it’s completely free.

Why should you care? Because money matters. Understanding your tax situation means fewer surprises, better budgeting, and maybe even a nice little refund. Plus, it helps you stay compliant and stress-free.

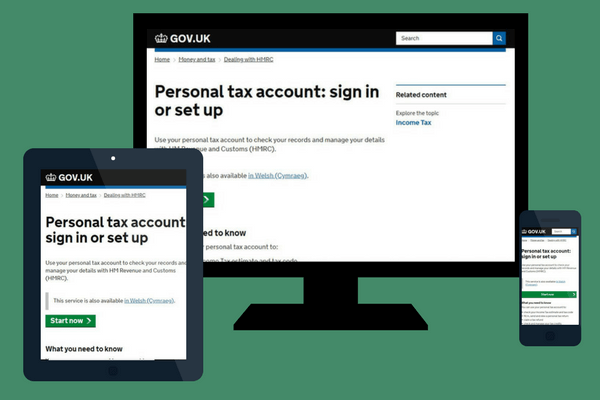

Setting Up Your Personal Tax Account: Simple Steps to Get Started

If you’ve ever set up an online banking account, this will feel familiar and maybe even easier.

To start, head to the official gov.uk website and create a Government Gateway account. You’ll need your National Insurance number, a valid email address, and a form of ID like your passport, P60, or payslip.

Next, verify your identity using one of the available options such as your passport and National Insurance number, or a recent payslip. personal tax account

Set up your two-factor authentication. This adds a crucial layer of security to ensure your data stays protected.

Once verified, log in and you’re in. You’ll land on your tax dashboard—the central hub of your PTA. Welcome to the future of tax management. personal tax account

Navigating Your Dashboard: What You’ll See Inside

Once inside your personal tax account, you’ll find a goldmine of information.

Your dashboard typically includes:

- Income Tax Summary: See what you’ve paid, what you owe, and your overall tax position.

- Employment History: Review all your job roles and the tax paid by each employer. personal tax account

- Tax Code Details: Understand what your tax code means and why it matters.

- National Insurance Contributions: See how much you’ve paid and how close you are to state pension eligibility.

- State Pension Forecast: Get a projection of your future payments based on your current contributions.

- Self Assessment: Submit your tax return if you’re self-employed or have additional income sources.

It’s like having a tax advisor in your pocket—digital, always available, and not charging by the hour.

Benefits of Using Your Personal Tax Account

Now that you’re familiar with what’s inside, let’s talk about the real-life perks of using your PTA. personal tax account

Transparency

You no longer have to guess how much tax you paid or if your tax code is correct. Everything is clearly displayed.

Convenience

Access your account anytime, from anywhere. No appointments, no calls, no waiting in lines. It’s open around the clock and easy to navigate.

Speedy Refunds

If you’re owed money, filing through your PTA often gets it back into your bank account faster than traditional methods. That’s a win for your wallet.

Error Correction

Changed jobs? Moved to a new address? Got the wrong tax code? You can update your details instantly inside your PTA without mailing forms or waiting weeks.

Proactive Tax Planning

You can forecast your taxes based on changes in salary, job, pension, or benefits. It’s like financial foresight in your control panel.

Real-World Scenarios: How People Use Their PT

Let’s bring this to life with a few practical examples.

Sam – The Freelancer

Sam juggles freelance design gigs and sells art online. She uses her PTA to file self-assessment tax returns, track earnings from different clients, pay tax directly from her account, and check Class 2 National Insurance eligibility.

John – The Employed Teacher

John works full-time but tutors in the evenings. Through his PTA, he updates additional income, monitors tax code changes, applies for Marriage Allowance, and tracks his annual tax summary.

Susan – The Retired Pensioner

Susan lives on her pension and occasional rental income. Her PTA helps her forecast her state pension, check NI gaps, and manage property income taxes. personal tax account

Everyone’s got a tax story. Your PTA helps you take ownership of yours.

Must-Know Features You Might Be Missing

There’s more inside your PTA than most users explore. Here are some hidden gems. personal tax account

Marriage Allowance

You can transfer part of your personal allowance to your spouse if they earn more, potentially saving you hundreds each year. personal tax account

Tax-Free Childcare

Apply and manage your childcare support straight from your PTA. This is a massive help personal tax accountfor working parents balancing careers and child expenses.

Class 3 Contributions

Top up your National Insurance to ensure a full state pension, especially useful if you’ve had career breaks or spent time abroad.

P800 Refunds

If you’ve overpaid tax during the year, HMRC may issue you a P800 form through your PTA. Accept it online and receive your refund without extra paperwork. personal tax account

Troubleshooting: Common Problems & Easy Fixes

Technology isn’t always flawless. Here’s how to handle the bumps.

If you can’t log in, reset your password using your registered email or phone number. For missing or outdated information, your records might not be synced yet, so check again later or contact HMRC for clarification. If your tax code looks incorrect, you can correct it directly in the portal or request a review. personal tax account

Use the virtual assistant chatbot for quick help, or call HMRC early in the morning to avoid long wait times.

Security and Privacy: How Safe Is It?

Your PTA uses strong security protocols like two-factor authentication, encrypted logins, and ID verification. Plus, it’s operated by HMRC, which has strict data protection standards. personal tax account

You can boost your own account safety by using strong, unique passwords, avoiding public Wi-Fi for logins, and keeping your contact details current.

Your financial data is valuable—protect it like you would your online bank account.

Future of the PTA: What’s Coming Next?

HMRC is continuously updating the PTA with smarter tools and more intuitive features. Here’s what’s likely coming soon.

Expect AI-powered tax-saving suggestions, better mobile functionality, income tracking tools for gig workers, and open banking features that sync income data automatically.

The platform is moving from useful to transformative, helping people make smarter financial choices at every stage of life.

Quick Tips to Maximize Your PTA

Here are some tips to get the most value out of your personal tax account.

Log in at least twice a year, even if there’s no big change, to keep your details fresh. Set tax deadline reminders to avoid late fees. Double-check your employer records for accuracy. Take advantage of tax allowances like Marriage Allowance and Tax-Free Childcare. And keep a close eye on your state pension forecast.

Consistency is key. Staying on top of things for a few minutes a month can save you big time later.

Final Thoughts: Make Your Personal Tax Account Work For You

Here’s the bottom line. The Personal Tax Account isn’t just another bureaucratic tool. It’s a powerful platform that gives you clarity, control, and confidence in your financial life.

If you’ve ever felt overwhelmed by taxes or unsure about your status, the PTA is your solution. Set it up, log in regularly, and use the features that fit your lifestyle. Whether you’re filing self-assessments, checking your tax code, or forecasting your pension, this tool has you covered.

Because when it comes to your money, knowing is winning. And with a few clicks, you can go from confused to confident, from reactive to proactive. The future of tax isn’t scary—it’s empowering.

For more practical tips and game-changing financial insights, check out TechbeTime, BuzzCraze, and TrendyInfo — your next smart move starts with knowledge.